Resources

- January 8, 2021

-

Views: 50

Water Futures Start Trading Amid Growing Fears of Scarcity

Warning: Array to string conversion in /home/domains/dev.landreport.com/public/wp-content/plugins/elementor/core/dynamic-tags/manager.php on line 73

Futures linked to the Nasdaq Veles California Water Index began trading on the Chicago Mercantile Exchange in early December, representing a whole new way to buy water. Amid concerns about climate change and resource scarcity in a state that uses four times more water than any other, turning H2O into a commodity akin to oil or cattle enables farmers, municipalities, and funds to wager on future pricing. According to Bloomberg, CME Group Inc.’s January 2021 contract finished on December 7 at $496 per acre-foot with two trades.

The announcement of the first-of-their-kind contracts came back in September as relentless wildfires and scorching heat sizzled much of the state. California was in a drought from December 2011 to March 2019, during which time water transactions totaled some $2.6 billion. Each contract represents 10 acre-feet of water or roughly 3.26 million gallons.

Click here to read more.

RELATED ARTICLES

Nebraska Farmland Rises Three Percent

Per the newly released 2020 Nebraska Farm Real Estate Market Survey, conducted by the Department …

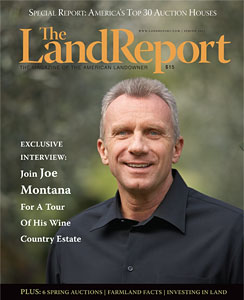

The Land Report Spring 2011

NFL Hall of Famer Joe Montana headlines the Spring 2011 issue of the Magazine of …

Missouri Regulators Approve Sale of Grain Belt Express Clean Line

In June, the Missouri Public Service Commission approved the acquisition of a proposed transmission line …

Elk Creek Ranch Acquires Seven Lakes

For those who are passionate about outdoor pursuits, the next great adventure can’t come soon enough.