Farmland, News Desk

- September 13, 2016

-

Views: 53

Guaranteed Loan Programs Find Favor

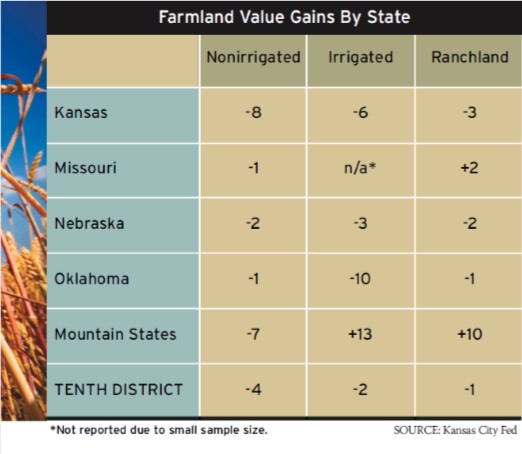

Ag lenders are reducing exposure to lending risks by requiring more farm real estate as collateral for large, non-real estate farm loans. –The Editors

Using responses from 213 banks, economists with the Kansas City Federal Reserve Bank presented a survey of Agricultural Credit Conditions covering the first quarter of 2016. A selection of observations by some of these bankers follows:

“Good quality land has still brought a premium at auctions. Marginal soil types have reduced in price or ‘no sold’ at auctions. Cash rents have remained steady.” – Southeast Nebraska

“Leveraged farmers are beginning to see their debt load increase and becoming harder to manage.” – Southeast Colorado

“Production expenses have not decreased in proportion to decreased market prices.” – Southeast Colorado

“Debt repayment on real estate and equipment loans is a big problem.” – Western Missouri

“Cow-calf areas have plenty of margin after annual debt service and living costs.” – Southeast Wyoming

Read the complete report at www.KansasCityFed.org.

Warning: Undefined array key 0 in /home/domains/dev.landreport.com/public/wp-content/plugins/elementor-pro/modules/dynamic-tags/acf/tags/acf-url.php on line 34

Warning: Undefined array key 1 in /home/domains/dev.landreport.com/public/wp-content/plugins/elementor-pro/modules/dynamic-tags/acf/tags/acf-url.php on line 34

RELATED ARTICLES

Mexican Wolves Allowed at Turner Ranch

The New Mexico Game and Fish Commission unanimously approved a request by the Turner Endangered …

Private Paradise

Established by ranch owners for ranch owners, EXPLORE RANCHES offers exclusive access to private landholdings …

Land Report Top 10: Swain’s Neck

Located on the Massachusetts island of Nantucket, Swain’s Neck is a one-of-a-kind waterfront estate. Sitting …

Elk Creek Ranch Acquires Seven Lakes

For those who are passionate about outdoor pursuits, the next great adventure can’t come soon enough.