Text by Corinne Garcia

Like millions of other citizen-soldiers, Henry Hall Sr. put a successful career at Connecticut Mutual Life Insurance on hold to serve his country during World War II. By the end of the war, however, his former position as the head of ag lending was no longer available. In fact, the only job at Connecticut Mutual that he could scrounge up wasn’t even at headquarters in Hartford; it was two time zones west in Colorado as an agricultural loan correspondent. Faced with few options, Henry and Nellie Hall journeyed to the Mile High City in 1946 where Henry and his older son, Warren, established Hall and Hall Mortgage Corporation. From this humble beginning, an iconic brand was forged.

Henry Hall would man the helm in Denver for the next 22 years. In 1954, Warren carried the flag to Billings, Montana, to open a second office. In 1959, Hall and Hall Inc. in Billings morphed into a separate company. The Denver branch of the family, under Henry Sr.; his two sons, Henry Jr. and Douglas; and grandson Michael, built the mortgage lending, appraisal, and brokerage business in Colorado and Southern Wyoming. The Billings branch of the family, under Warren and his son, Doug, and Jim Taylor, moved aggressively into ranch real estate. “I had this concept that ranches needed to be marketed on a national and an international basis. Hopefully, there were investors that would look at ranchland as a standalone investment,” Taylor says.

Who better to prove Taylor right than Malcolm Forbes? In 1968, the publisher of Forbes paid $600,000 for a Montana ranch. The six-figure price worked out to a sky-high valuation of $1,000 per cow unit. Yet just ten years later, that same ranch sold for $7 million. The dam was about to break. (Learn more about the Forbes and their legacy in The Land Report Winter 2014.)

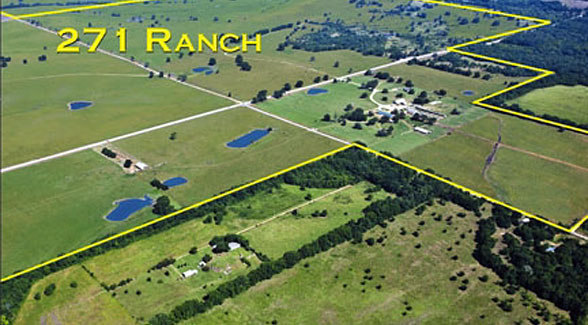

In 1989, Bobby Shelton gave Hall and Hall Inc. an exclusive one-person listing to show Ted Turner the 107,000-acre Flying D Ranch. Shelton thought it inconceivable that the cable TV mogul would agree to his terms. He thought wrong. The $21 million purchase price was a game-changer. It not only raised the bar in ranch real estate, but it confirmed what Taylor had divined: investment-quality rural real estate was an asset class unto itself. Decades later, Taylor and his colleagues took this concept one step further when they successfully launched Hall and Hall Auctions. The goal? Greater liquidity for the asset class.

The Flying D was not the first ranch Turner bought with Hall and Hall. Nor would it be the last. All told, Turner Ranches relied on Hall and Hall to help acquire a significant part of his portfolio totaling more than 2 million acres in the United States and overseas.

In the late 1980s, Doug Hall and Jim Taylor were sole owners of Hall and Hall Inc. Then the two invited Joel Leadbetter and another broker to buy in as shareholders. The resulting structure was a unique brokerage model: an employee-owned firm. “As an employee-owned company, we’ve assembled a great team of men and women, many of whom are shareholders. Everybody has a seat at the table. We all work together,” says Leadbetter, who succeeded Taylor as managing director.

In the late 1980s, Doug Hall and Jim Taylor were sole owners of Hall and Hall Inc. Then the two invited Joel Leadbetter and another broker to buy in as shareholders. The resulting structure was a unique brokerage model: an employee-owned firm. “As an employee-owned company, we’ve assembled a great team of men and women, many of whom are shareholders. Everybody has a seat at the table. We all work together,” says Leadbetter, who succeeded Taylor as managing director.

“This structure requires a group that’s very dedicated to the same principles and work ethic,” says Doug Hall, now chairman emeritus.

As Hall and Hall Inc. grew, the idea of reuniting with Hall and Hall Mortgage emerged as an obvious move. That took place in 2000, and the results speak for themselves, most recently with the record-breaking sale of the W.T. Waggoner Estate Ranch in February. “It’s been a record year, so there’s a pretty good feeling around these offices,” Doug says.

In 1968, when Henry Sr. stepped down, he gave his successors a bit of advice: “Together, we have built a reputation, a modest living, and a way of life that is rewarding to me. Now it is yours. Nurture it. Devote your energies to expansion, diversification, and integrity.”

Boy, did they.

News Desk

- October 11, 2016

-

Views: 356

Hall and Hall Celebrates 70 Years

RELATED ARTICLES

Sponsored

Elk Creek Ranch Acquires Seven Lakes

For those who are passionate about outdoor pursuits, the next great adventure can’t come soon enough.

Please sign me up to receive breaking news and updates from The Land Report: